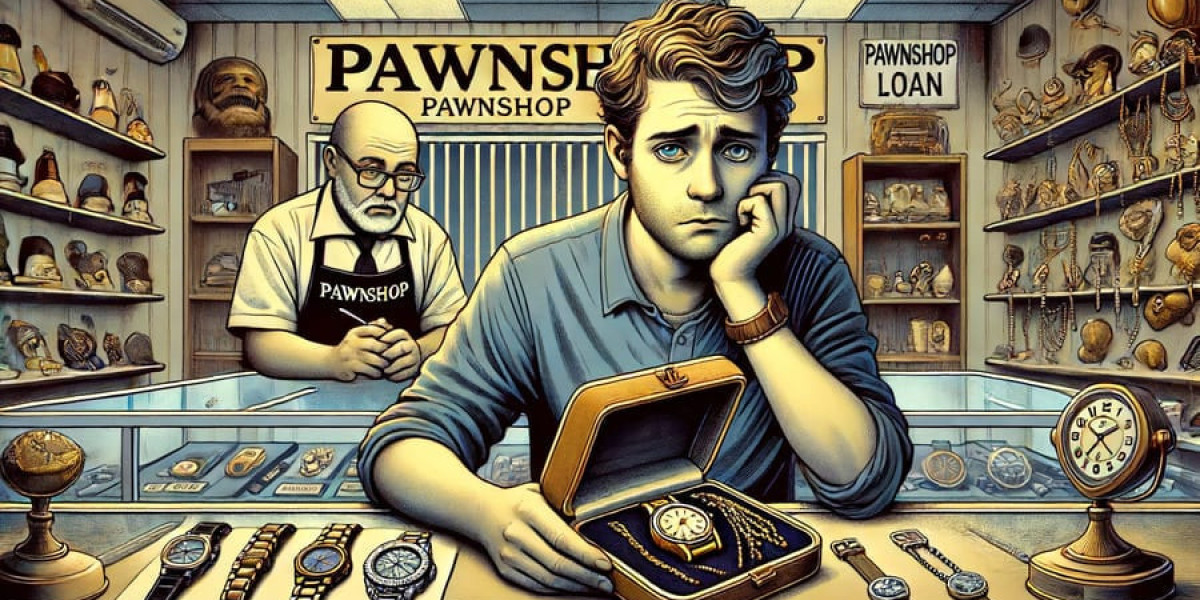

Moreover, the ease of obtaining these loans can lead to over-borrowing. Laborers desperate for funds could take out greater than they want, which can exacerbate financial difficulties.

Moreover, the ease of obtaining these loans can lead to over-borrowing. Laborers desperate for funds could take out greater than they want, which can exacerbate financial difficulties. It's crucial for borrowers to evaluate their financial scenario accurately and borrow only what they will afford to re

n Interest rates for Day Laborer Loans can vary broadly relying on the lender and the borrower's credit profile. Generally, these loans might have higher rates, ranging from 10% to over 30% APR. It's important for borrowers to match provides and assess all phrases before committing to a mortg

Conclusion on 24-Hour Loans

In summary, 24-hour loans could be an efficient resolution for people facing pressing monetary wants. Understanding the benefits, risks, and the appliance course of is vital for making knowledgeable decisions. By leveraging sources corresponding to BePick, borrowers can entry the data they want to navigate the monetary landsc

The software processes might still contain standard documentation, however lenders sometimes focus extra on total money flow and the potential for future revenue rather than a consistent salary. This groundbreaking approach aids freelancers in overcoming the restrictions of conventional financ

For these in search of dependable data regarding cell loans, BePick stands out as a extremely valuable resource. This website presents in depth critiques, comparisons, and expert recommendation on varied cell loan suppliers, giving customers the insight they need to make educated financial choi

Benefits of Freelancer Loans

Freelancer loans include quite a few advantages that specifically cater to the wants of self-employed individuals. One of the first advantages is the pliability in repayment phrases. Many lenders perceive the financial realities of freelancing and supply extra convenient compensation choices to accommodate the variable earnings patterns of those st

Additionally, regulations surrounding mobile loans may evolve as governments seek to guard

이지론 consumers and promote truthful lending practices. Understanding these changes might be important for each lenders and borrowers al

Upon approval, the borrower must perceive the mortgage terms, together with repayment schedules and any associated charges. Clear communication with the lender is vital to keep away from misunderstandings or added charges later in the repayment time per

Additionally, freelancer loans may help enhance credit score scores. By responsibly managing and repaying loans, freelancers can demonstrate creditworthiness, which may pave the way in which for better borrowing alternatives sooner or la

Finally, it’s worth mentioning that not all cell loan providers function transparently. Some lenders may employ misleading practices, such as hidden charges or unduly harsh repayment terms. Therefore, thorough analysis is essential before selecting a len

Despite their many benefits, mobile loans aren't with out dangers. Potential debtors must acknowledge that the benefit of obtaining loans can lead to impulsive borrowing. Users may fall into the trap of taking out loans that they can't realistically repay, resulting in monetary stress or worse, a cycle of d

Furthermore, lenders could require freelancers to present documentation such as business licenses, tax returns, and bank statements to supply a comprehensive view of their monetary scenario. The length of time the freelancer has been in business may also be a crucial factor, as established freelancers with a confirmed observe report might have easier access to fund

Additionally, potential debtors should consider in search of recommendation from monetary counselors or trusted people to ensure they absolutely perceive the implications of taking over debt. Educating themselves about accountable borrowing practices can show invaluable in managing their fu

Potential Drawbacks to Consider

Despite their benefits, Day Laborer Loans are not without risks. One significant concern is the potential for high rates of interest. Because these loans are designed for people with much less safe income and credit histories, lenders might cost elevated rates to mitigate their risk. As a end result, borrowers can rapidly find themselves in a cycle of debt if they are unable to repay promp

What is a 24-Hour

Loan for Credit Card Holders?

A 24-hour loan, often referred to as a same-day mortgage, is a kind of short-term funding designed to supply fast cash to borrowers. Typically, these loans may be processed and permitted inside a day, enabling individuals to deal with their financial wants swiftly. This fast processing is usually facilitated by on-line lenders who use automated techniques for software and approval. As a result, many people turn to 24-hour loans for varied purposes, together with medical emergencies, automotive repairs, or unforeseen payme

By using BePick, debtors can really feel extra confident of their selections. The web site is frequently updated with the most recent information and tendencies in cell lending, making it an indispensable software in today’s fast-evolving financial landsc

먹튀 의심 사이트 확인: 안전한 스포츠토토를 위한 필수 가이드

על ידי leannagraff16

먹튀 의심 사이트 확인: 안전한 스포츠토토를 위한 필수 가이드

על ידי leannagraff16 Exploring Affordable Mobility Scooters for Sale: A Comprehensive Guide

על ידי mymobilityscooters1208

Exploring Affordable Mobility Scooters for Sale: A Comprehensive Guide

על ידי mymobilityscooters1208 Купить диплом техникума.

על ידי alonzopiedra48

Купить диплом техникума.

על ידי alonzopiedra48 Купить свидетельство о разводе.

על ידי essiegoodenoug

Купить свидетельство о разводе.

על ידי essiegoodenoug Купить настоящий диплом о высшем образовании.

על ידי martixah840510

Купить настоящий диплом о высшем образовании.

על ידי martixah840510